Japanese mini trucks have gained significant popularity among local small business owners, hobbyists, and those looking for practical hauling solutions. Understanding how much a Japanese mini truck costs involves delving into various factors—like whether you’re eyeing a new model, exploring the used market, or considering different brands. Whether you’re a property owner needing reliable transport or an enthusiast seeking the perfect ride, this guide will walk you through the key elements influencing mini truck pricing, from regional differences to trends in the marketplace. Get ready to uncover the costs associated with these compact workhorses and find the perfect fit for your needs!

Decoding the Price Tag: What Drives the Cost of Japanese Mini Trucks

When evaluating how much a Japanese mini truck costs, it’s not simply a matter of sticker price. A complex interplay of engineering choices, regulatory limits and market forces shapes the final figure. Understanding these influences helps buyers anticipate both the upfront investment and the long-term ownership expenses.

At the heart of any Japanese mini truck lies its powerplant. Engine type—gasoline versus diesel—often represents the first fork in the cost road. Gasoline variants usually carry a lower entry price, owing to simpler emission controls and lighter hardware. In contrast, diesel engines boast better fuel economy and torque characteristics suited for hauling heavy loads over time. That durability can translate into longer service life, but it also adds to the initial manufacturing expense. Buyers planning intensive agricultural or construction use may pay more upfront for diesel, yet offset that premium through reduced fuel consumption and fewer rebuilds down the line.

Moving beyond the engine, compliance with Japan’s strict kei-class regulations further defines mini truck design and cost. Limits on engine displacement (under 660 cc), vehicle width and height force manufacturers to optimize space and performance within tight constraints. Engineering a compact yet functional chassis, installing lightweight safety reinforcements and implementing advanced emission controls all require additional R&D investment. When regulations update—say, introducing more stringent exhaust standards—manufacturers must redesign components or integrate new filtration systems, raising production costs. These expenses inevitably filter into showroom prices.

How a mini truck will be used also plays a decisive role in its price. Models tailored for urban last-mile delivery differ significantly from rural farm variants. Urban delivery trucks often include reinforced suspension, maneuverable wheelbases and advanced telematics for tracking and route planning. To support e-commerce demands, some are built with insulated cargo boxes or quick-swap batteries for electric versions. By contrast, agricultural models prioritize durability: reinforced underbody shielding, high-ground-clearance options and off-road-capable four-wheel drive systems. These specialized features may increase the retail price by several thousand dollars compared to a base model intended for light hauling.

Demand dynamics in global markets further stir the pricing pot. As e-commerce expands worldwide, small, nimble cargo vehicles become invaluable for last-mile logistics. When shortages arise due to rising orders or supply chain bottlenecks, prices climb accordingly. Imported used trucks, often sourced from Japan’s domestic salvage auctions, can command premiums in markets where new units aren’t readily available. Conversely, an oversupply of certain models can suppress prices, creating buying opportunities for fleet operators. Attention to both local market trends and international demand cycles enables shrewd timing for purchase decisions.

A major recent trend reshaping cost structures is the shift toward electric mini truck variants. Electric drivetrains bring the allure of zero tailpipe emissions and lower maintenance, yet their battery packs and power electronics carry hefty development and production costs. Lithium-ion cells alone can account for 30 to 40 percent of the vehicle’s parts costs. On the plus side, electric models benefit from simplified transmissions (often single-speed) and fewer wear components. Some Japanese automakers are testing partnerships with Chinese and domestic battery suppliers to streamline production, but until economies of scale kick in, these variants often start at a premium above their gasoline or diesel siblings.

Global production strategies deeply influence final pricing, too. Many manufacturers are exploring localized assembly in countries with lower labor rates—China, Vietnam and parts of Southeast Asia. By shifting certain production stages overseas, companies can reduce manufacturing overhead. However, this approach sometimes necessitates extra logistical coordination, quality control measures and potential tariffs when exporting back to key markets. Savings on labor may be offset by increased shipping costs or border duties, creating a delicate balance that ultimately determines the price tag.

Operational factors round out the total cost picture. Fuel efficiency, maintenance schedules and parts availability vary widely between brands and engine types. Diesel mini trucks often achieve mileage in the range of 30–35 miles per gallon, while gasoline versions typically register around 25–28 mpg. Electric models, by contrast, might offer the equivalent of 50–60 mpg when energy consumption is converted—though electricity rates vary by region. Routine service items—oil changes, air and fuel filters—tend to cost more for diesel units due to premium filter elements and specialized fluids. Meanwhile, electric trucks require periodic battery health checks and coolant system maintenance, specialized tasks that can demand both training and diagnostic equipment. Buyers should factor in regional service support and the ubiquity of replacement parts when comparing long-term expenses.

Taken together, these elements form a coherent narrative explaining why Japanese mini truck prices range from under $10,000 to upwards of $20,000 for specialized models. A basic gasoline kei-class micro truck, constrained by kei regulations and featuring minimal amenities, may start near the lower end. A diesel workhorse with reinforced suspension and off-road gearing will cost more. Electric versions, supported by advanced battery systems and telematics, command the highest premiums. Buyers can tailor their investments to match their needs: select a stripped-down work model if budget concerns dominate, or opt for feature-rich variants when total lifecycle value outweighs initial outlay.

For those seeking a deeper dive into engine specifications, regulatory impacts and best practices across models, the technical analysis at Japanese Mini Truck Engines Explained: Technical Specifications, Features, and Best Practices offers extensive insights. To explore practical case studies and detailed comparisons among various mini truck configurations, the collection of industry news and buyer experiences on our blog provides real-world context and user feedback on price versus performance trade-offs.

The Price Bridge: How Much a Japanese Mini Truck Costs—New Versus Used

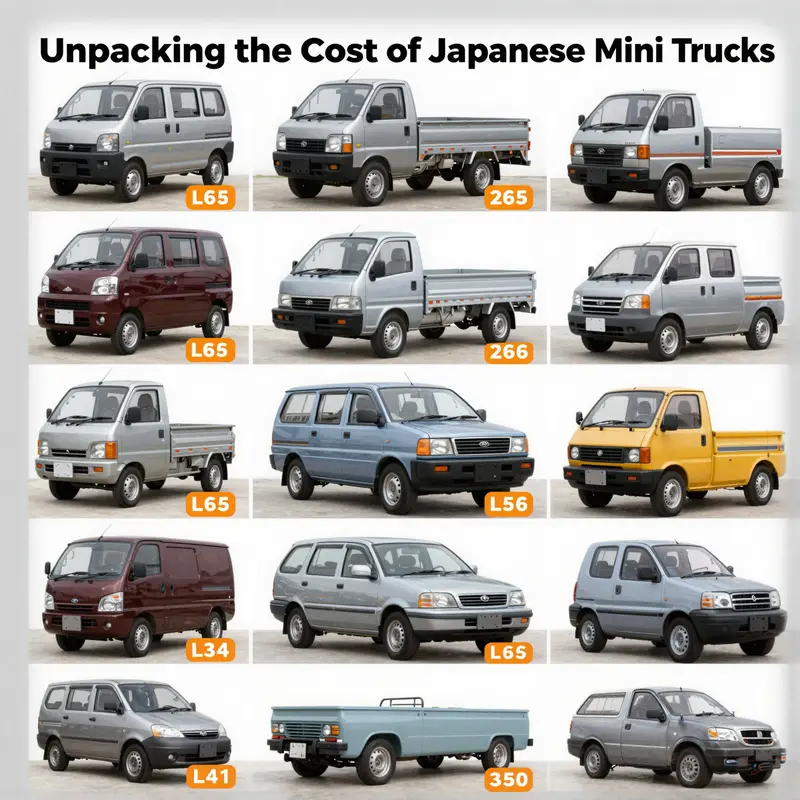

Pricing a Japanese mini truck is rarely a straight line from factory gate to buyer’s wallet. The question at heart—how much does a Japanese mini truck cost?—unfolds into a broader story about markets, regulations, and the practical realities of buying a compact workhorse that is small in size but big in utility. When you compare fresh units with secondhand imports, the same chassis can appear in two very different universes: one governed by a domestic appetite for compliance, tax efficiency, and local work patterns; the other shaped by international logistics, certification hurdles, and the long tail of depreciation. To understand the price bridge between new and used, you need to trace the forces that pull price up and down, from the engine and body configuration to the way a vehicle ends up crossing oceans and customs lines. The result is a spectrum rather than a single number, a spectrum that reflects who buys, where they buy, and why a small truck remains in demand across continents.

In Japan, new mini trucks are often bundled with regulatory constraints that keep model dimensions and engine displacements compact. These K-CAR configurations are designed to deliver reliability, fuel efficiency, and approachable operating costs within the frame of Japan’s taxation regime. For buyers in the domestic market, a basic new mini truck can be priced to appeal to small businesses and rural users who need a straightforward work tool rather than a showroom spectacle. The price scale starts with the most economical configurations and then climbs as payload capacity, drivetrain options, and specialized features—the kind that make a dump bed or a tipper more practical for certain kinds of job sites—are added. In practical terms, the base price for a basic new mini truck is often presented in a way that makes the everyday job simpler: affordable initial outlay, predictable maintenance, and straightforward parts availability. The result is a price range that, in international terms, sits at the lower end of the spectrum—yet can still reflect the value of a vehicle purpose-built for efficient small-scale work.

The landscape shifts dramatically once you step into the used market or look at parallel imports. A well-maintained used mini truck——the same size that serves urban deliveries, rural farm tasks, and light construction—tends to offer a compelling value proposition. In many markets outside Japan, the cost of acquiring a used Japanese mini truck is shaped by two big variables: the price paid in the export country and the added costs of shipping, inspections, and compliance for the destination. Wholesale channels and auctions—where many of these vehicles turn up—can yield prices well below what a new unit would command, even after you factor in all import-related expenses. The seduction of a used model lies in its proven reliability and simple mechanicals, which translate into lower maintenance costs and a more predictable total cost of ownership over time. A used unit can appear to be a bargain in the short term, but buyers must account for condition, mileage, and the availability of spare parts, especially in markets where the original equipment might not be commonly stocked in local shops.

Among the concrete patterns that buyers often see, the range of new prices spans roughly from the low five digits in USD to well above that for more capable or specialized configurations. A basic new entry-level micro truck can be found in the neighborhood of ten thousand dollars, while more robust or feature-rich variants—such as those with larger payloads, dump capabilities, or all-wheel drive—tend to move into the mid-teens or higher. In markets that have embraced electrification or export-driven customizations, the price ceiling can rise further, reflecting the added value of battery technology, range, and the governance around charging infrastructure. When expressed in local currency, the equivalents reinforce how price is a function of local taxation and exchange rates as much as it is of engineering and build quality. In the Japanese context, the price floor for a basic new model might look modest, but the international journey of that vehicle—through freight, duties, and certification—can push the landed cost into a different ballpark altogether. The end price becomes not merely a sticker on the vehicle, but an intersection of origin, path, and destination.

Turning to used inventory, the numbers tell a similarly pragmatic story. In wholesale and auction markets, the used category frequently presents a more favorable short-term return for buyers who can tolerate older design generations, higher mileage, or more basic feature sets. For example, older medium-duty Japanese mini trucks with standard diesel or gasoline engines often land in a price range that sits roughly in the mid-to-high tens of thousands of dollars when viewed in a global context. In addition to direct vehicle cost, buyers must account for import logistics: shipping costs, freight insurance, and the often substantial costs of meeting regulatory requirements in the destination country. The savings on the purchase price can be substantial, but they come with the need for due diligence. Frame integrity, engine wear, and the condition of the bed and hydraulics are common hot spots to check during inspection. The story is nuanced: a well-maintained used unit can outpace a new entry-level model on price and still deliver reliable uptime, while a poorly maintained example can become a money pit quickly. These are the real-world tradeoffs that define the value equation for used mini trucks.

One thread that runs through both new and used markets is the effect of engine type and drivetrain on price. Gasoline and diesel configurations carry different costs in maintenance and fuel efficiency, and the choice often hinges on the intended use. For light-duty tasks that require nimbleness and frequent short trips, a gasoline engine might be ample and economical. For heavier work, longer operating hours, or rough terrain, a diesel setup can offer the torque and durability that pay off over the longer term, even if the upfront price is higher. In the used market, the presence of a diesel engine can also influence resale value in several markets where diesel has long been prized for durability and easier field maintenance. Electric variants, while less common, are starting to appear in some regions and bring a separate pricing trajectory altogether. Their price bands can extend beyond traditional internal-combustion models due to battery costs, charging compatibility, and the premium placed on lower running costs and emissions profiles. These factors together form a broader picture: the price tag on a Japanese mini truck is a composite of the vehicle’s core capabilities, its regulatory journey, and the economics of the buyer’s locale.

For buyers navigating this landscape, the practical path is to weigh landed cost against expected lifespan and serviceability. A new unit promises a clean slate—full warranty, modern safety features, and the certainty of a known maintenance history—but it comes with a higher initial entry price in global terms once export and regulatory costs are added. A used unit offers an attractive price point, but the total cost of ownership can swing with mileage, repair needs, and the availability of parts in the destination market. These variables are not abstract; they translate into decisions about how big a payload you need, how many hours you plan to put the truck to work, and how soon you must return a usable asset to the fleet. In markets where import channels are well established and reputable exporters operate with transparent histories, the leap from a domestic price to an international landed price becomes more predictable. For other buyers, the gap can look daunting, especially when currency fluctuations and evolving regulatory requirements are factored in.

What, then, is the bottom line for someone weighing a new versus a used Japanese mini truck? The prudent approach is to anchor your decision in intent. If your operation depends on a vehicle that looks, feels, and performs like new, with predictable maintenance costs and warranty coverage, a new unit provides peace of mind at a cost that reflects its domestic supply chain and regulatory compliance. If your timeline allows for flexibility and you can tolerate some risk around mileage and wear, a well-evaluated used unit often delivers more value per dollar—provided you conduct thorough due diligence and work with reputable exporters who can present verifiable service histories and spare parts availability. In either case, the price anchor remains a function of the vehicle’s capabilities, the regulatory framework it must navigate, and the logistics of moving it from origin to use. The most successful buyers are those who treat price as the doorway to a broader ROI: uptime, reliability, and the capacity to keep a small but essential fleet moving without interruption.

For readers who want a sense of current market availability and listings, a practical next step is to explore real-time opportunities through established auction and export channels. A helpful resource for accessing transparent used-vehicle listings is the Minitrucks Cala blog, which curates insights and practical tips for buyers and exporters alike. See the linked resource for more context and current listings: Minitrucks Cala Blog.

External resource: real-time listings and pricing on used Japanese commercial vehicles can be found via Japan Auctions International: https://www.japan-auctions-international.com. This resource provides a snapshot of market dynamics, including average price ranges, model variations, and shipment considerations that influence the overall cost of ownership when buying from overseas channels.

Borders, Budgets, and Kei Trucks: A Regional Price Landscape for Japanese Mini Trucks

Prices for kei trucks, those small workhorses that are iconic in Japan, do not translate a single figure across the globe. The cost of owning one depends on where you are, the local regulations that apply, and the practical realities of moving a vehicle across borders. Regional differences in import rules, demand density, and the cost of compliance create a price map that can be as varied as the terrain these tiny trucks are designed to work on. The same basic machine can arrive on a dealer lot in one region at a price that makes it a practical entry-level commercial vehicle, while in another region the same model may carry a far heftier sticker price once the paperwork and adaptation costs are tallied. Understanding this landscape requires looking beyond sticker prices and recognizing the layers that accumulate as a kei truck changes continents.

In the United States, for example, the market for used kei trucks tends to sit within a broad band. On the lower end, you will find units that have seen years of service, limited maintenance records, or modest mileage. On the higher end, well-kept examples with four-wheel drive and practical payloads can command noticeably larger figures. A typical range—before the costs of shipping and import clearance—sits roughly between four thousand and fifteen thousand dollars. That spread reflects not just condition and mileage, but the reality that buyers are weighing utility against the realities of import logistics and potential adaptation work. When import fees, inspections, and shipping are factored in, the total landed cost can rise to as much as nineteen thousand dollars. The market in the United States has tended toward stability after a period of fluctuations, with prices stabilizing as dealers and private sellers become more familiar with the constraints and opportunities of cross-border trading. This stability masks ongoing volatility in the horizon, since currency movements, batch importings, and shipping costs can still swing prices in the short term.

To someone in the United States considering a kei truck, the calculation often centers on whether the vehicle’s compact size and light-duty capacity justify the lead time and the unfamiliarity of import procedures. The price band is a reminder that you are not simply buying a cheap vehicle; you are navigating a small, specialized market that rewards a willingness to handle logistics and to learn the nuances of cross-border ownership. In this sense, the price is a signal of both value and risk. Buyers frequently weigh the vehicle’s potential for DIY maintenance, the availability of parts, and the practicality of road legalities in their state against the initial outlay. Those calculations, in turn, influence demand and, subtly, price. The picture in the United States is instructive for understanding how regional economics shape what a buyer can expect to pay for a compact work vehicle that was not designed with left-hand traffic in mind.

Across the Atlantic, Europe presents a different pricing equation. European buyers encounter stricter emissions standards, more demanding safety and compliance requirements, and the reality that many markets are built around a more formal vehicle registration framework. These factors add layers of cost well beyond the sticker price. Emissions compliance, potential conversion work to meet local standards, and the logistical complexity of handling documentation for a right-hand-drive vehicle all contribute to higher price thresholds. The digitized marketplace can still offer used kei trucks, but the added costs associated with achieving full regulatory compliance in multiple European jurisdictions tend to push transaction prices upward relative to the United States. In many European markets, the combination of stricter environmental mandates and the penalties for non-compliance translates into a premium for entrants who want a practical compact light-duty vehicle without sacrificing the convenience of import channels. This premium reflects not only the vehicle’s age or condition but the certainty that the vehicle will pass local inspections and operate smoothly within the region’s regulatory framework.

In Southeast Asia, the price dynamic shifts again. Here, the regulatory framework often allows more flexibility for imported light-duty work vehicles, and regional trade networks can shorten the path from seller to end user. As a result, the base prices on the market can sit at a lower level compared to Western markets, owing to a combination of looser regulatory requirements and a more mature ecosystem for regional imports. Access to a broader pool of used stock sourced through neighboring markets, along with established routes for shipping and registration, helps keep prices more approachable for buyers who value practicality and compact form factor over pristine originality. In this context, buyers frequently see a faster route to ownership and lower barriers to entry, enabling steady demand for these small, nimble trucks in commercial and agricultural settings where heavy equipment is impractical or unnecessary.

A useful snapshot of regional price behavior can be found in the way a 4×4 or four-wheel-drive variant might price itself in online marketplaces. A base price for such a configuration on regional marketplaces can begin around six thousand eight hundred dollars, illustrating how features and drivetrain choices interact with local demand to shape the bottom line. This example demonstrates that base prices are not universal; they rise or fall with the weight of regional constraints and preferences. It is the regional context that explains why a fleet manager in a coastal Southeast Asian city may find a different value proposition than a small business owner in a European town with stringent regulatory demands.

When considering new versus used in this regional matrix, the line of thought often splits accordingly. In Western markets, new kei trucks are rarer and frequently priced at levels that reflect niche appeal and limited supply, while used examples dominate the scene and command price points that align with condition and service history. In regions with robust import channels, a reliable used model can deliver immediate value, especially when it pairs with a trusted service network that can handle routine maintenance and spare-parts availability. Conversely, in markets where imports are less predictable or where the vehicles must meet stricter standards before sale, even a used unit can carry a higher premium due to the costs of verifying compliance or performing necessary upgrades to meet local requirements. The upshot is that regional price variation is less about the absolute cost of the vehicle and more about the total cost of ownership in a given jurisdiction.

To deepen the understanding of cross-market price dynamics, readers can consult comparative discussions that explore how equipment features, drivetrain options, and market-specific preferences influence pricing across regions. For instance, a detailed comparison of model variants and specifications across markets highlights how similar platforms are priced differently depending on local demand and regulatory complexity. See this comparative resource for a focused look at how features and specs drive price in this category: comparing-kingstar-kruzr-models-specs-features. This kind of resource helps illustrate that what looks like a simple purchase decision—“how much does a kei truck cost?”—is really a composite choice shaped by where you buy and how you will use the vehicle.

Beyond the sticker price, buyers should consider the broader price ecology that governs regional markets. Import taxes, registration fees, and necessary inspections can all add material costs that alter the total ownership figure. Currency fluctuations will also shift pricing for buyers who rely on overseas suppliers or who operate in markets with volatile exchange rates. Shipping costs, port handling fees, and the time required to clear customs further complicate the math, especially for small fleets or solo buyers who are balancing cash flow against vehicle availability. In some regions, incentives for small commercial vehicles or favorable tax treatment for low-emission or fuel-efficient machinery can tilt comparisons in favor of one option over another, even when the base price is similar.

For readers seeking the most precise and current regional pricing, the sensible approach is to consult official automotive import databases and reputable international vehicle marketplaces. These sources are more likely to reflect the latest regulatory changes, currency movements, and shipping realities that influence real-world costs. They also help buyers distinguish between genuine regional bargains and listings that appear attractive but carry hidden costs hidden in the fine print. When exploring regional markets, it is essential to keep sight of the big picture: the price you see is only one facet of ownership, with regulatory compliance, maintenance access, and total cost of ownership playing equally important roles in determining true affordability.

External resource for further reading on how to evaluate a tiny Japanese pickup truck in different markets is available here: https://www.carinterior.com/how-to-choose-a-tiny-japanese-pickup-truck/

null

null

Pricing in Motion: How Market Currents Shape the Cost of a Japanese Mini Truck

Prices for Japanese mini trucks do not sit still. They drift with the tides of economy, policy, technology, and the everyday choices of buyers who rely on these compact workhorses for urban deliveries, farm chores, and small-business logistics. Because the mini-truck market in Japan is both specialized and highly concentrated, the cost of entry, whether new or used, is a reflection of more than sticker price. It is a mirror of government policy, driver supply, fuel and maintenance costs, and the pace of electrification. What follows is a synthesis of how those forces translate into the numbers a customer actually pays, from showroom floor to used-vehicle lots, and why those numbers can vary with little warning.

The spectrum of new mini-truck prices begins in the mid-range, with entry-level, basic configurations priced around 1,513,600 JPY for a manual transmission model and around 1,612,600 JPY for an automatic variant. Those figures sit at the core of a mature, domestic market where buyers value compact size, low running costs, and nimble performance in narrow streets and tight loading docks. For buyers considering a truly electric option, the price picture shifts dramatically. A newly launched electric mini truck from a startup and assembled abroad is listed at about 380 million JPY, with a USD equivalent around 2,450. The contrast between the standard internal-combustion options and the electric newcomer is stark, underscoring how policy incentives and battery prices can create a new price tier that redefines what “affordable” means in urban freight.

Used mini trucks, by contrast, exist on a different curve. They sit lower on the scale, but with a geographic and condition-driven spread that can stretch from modest to robust depending on age, mileage, and duty cycle. Wholesale channels and import markets show a wide band. For instance, a used 4×4 pickup with a diesel engine is commonly listed in the neighborhood of $12,550 to $15,850, a range that reflects not only mechanical condition but the premium buyers are willing to pay for the rugged capability and the relatively small size that suits Japanese urban needs. A broader look at used stock also reveals that a 5-ton mini truck can be priced from roughly $12,000 to $16,000, again highlighting how capacity and drivetrain options recalibrate value in the pre-owned market. Taken together, new versus used, manual versus automatic, diesel versus electric, the price landscape becomes a map of how the market assigns risk, reliability, and potential return on investment for a workhorse that is, at heart, a practical tool rather than a luxury.

This pricing mosaic cannot be understood without recognizing the underlying macro forces that shape each node on the map. The economic backdrop in recent years has been one of volatility and cautious consumer sentiment. Japan’s economy has faced headwinds, including a Q1 2025 quarterly contraction that underscored fragility in public investment, exports, and household spending. When inflation squeezes the budgets of small businesses and individual buyers alike, new-vehicle purchases—especially for practical, lower-cost categories like mini trucks—tend to soften. In such an environment, the appeal of a well-maintained, low-mileage used model grows, even as the cost of ownership rises with maintenance and spare-parts availability. The result is a market where price stability for new products is tempered by buyers’ willingness to stretch toward used or refurbished options.

Government policy intensifies these dynamics in multiple ways. On the labor side, the labor and driver shortage policy changes enacted in recent years have altered the economics of transport. The cap on overtime for truck drivers reduces the premium that trucking contractors previously could rely on to justify large investments in newer, more expensive fleets. With overtime income no longer a guaranteed revenue stream, operators face higher per-move costs, and that pressure can translate into more conservative procurement of new vehicles. The same regulatory environment that aims to protect workers also nudges the market toward more cost-effective, durable long-life units rather than frequent upgrades to the newest models. Environmental regulations compound the effect, forcing manufacturers to absorb higher R&D and production costs to meet stricter emissions standards and cleaner powertrains. Those costs, in turn, are often passed along to buyers, lifting the base price of new mini trucks in ways that reflect the long-term push toward cleaner fleets.

Taxation and incentives add further layers. Government support for new-energy vehicles (NEVs) can dramatically alter the relative affordability of electric models. Subsidies or tax incentives for EVs can shrink the effective purchase price, making electric mini trucks more competitive against conventional diesel or gasoline variants. Conversely, any adjustments to corporate taxes or import duties can shift production costs for domestic and foreign manufacturers, affecting sticker prices and financing terms for buyers. In a market as concentrated as Japan’s—where a few major players control a substantial portion of the standard-truck segment—the pricing power of those manufacturers matters. Economies of scale, relationships with dealers, and the ability to weather shifting exchange rates can all influence the price trajectory for the entire category.

Demand and supply dynamics help complete the picture. Mini trucks have the largest share of the domestic truck market—roughly half of all truck sales in the latest year—because their size and efficiency suit Japan’s narrow streets and urban loading zones. This dominant position affords manufacturers some pricing power, allowing them to maintain price points that reflect the vehicles’ utility. The market is highly concentrated, with a handful of manufacturers commanding the bulk of sales. This concentration supports predictable pricing at the top end and a stable supply of parts and service that can justify a premium for newer configurations or better-warranty terms. Yet the same concentration makes the market sensitive to policy shifts, fuel prices, and the pace of electrification. When EVs begin to scale, pricing strategies will likely adjust in two directions: premium pricing for cutting-edge technology supported by state incentives, and eventually, more competitive pricing as battery costs fall and supply chains mature.

Technology is the engine driving the future of these prices. The transition to electrification is the most talked-about factor shaping the long arc of price movements. Battery costs, charging infrastructure, and vehicle range are the variables that determine the acceptance and price of electric mini trucks. Early EV entries into this segment often carry premium pricing tied to batteries and the novelty of the powertrain. As production scales and supply chains mature, economies of scale should help bring these prices down, even as regulatory frameworks continue to tilt incentives in favor of greener fleets. For buyers, the implications are clear: the cost of a mini truck in a few years will reflect not only the model year and configuration but also the available charging ecosystem and the total cost of ownership over the vehicle’s life.

From a practical perspective, buyers facing this pricing landscape can benefit from a few strategic considerations. First, recognizing the total cost of ownership—maintenance, fuel, insurance, and depreciation—helps in choosing between a new basic model and a well-kept used unit. Second, factoring in potential incentives for electric models can alter the calculus, sometimes turning a higher sticker price into a lower long-run cost of operation. Third, verifying the availability of parts and service in one’s region reduces the risk of unexpected maintenance expenses that can erase attractive depreciation advantages. And finally, staying informed about regulatory changes related to driver hours, emission standards, and import policies helps buyers anticipate price moves rather than react to them after the fact.

For readers seeking a broader context on how policy and market dynamics shape vehicle pricing beyond the micro-truck category, industry analyses and policy reviews offer valuable benchmarks. A recent synthesis of global market trends and energy considerations provides a macro view of how electrification, inflation, and regulatory frameworks interact to set price trajectories across light commercial vehicles. Those insights can illuminate why a simple price tag on a mini truck embodies a broader set of trade-offs, from urban efficiency to environmental responsibility, and from labor market conditions to technological progress. To explore such perspectives, see the external resource linked at the end of this chapter.

This chapter has traced how the price of a Japanese mini truck arises from a web of interdependent factors. The numbers—new models around the mid-1 million-yen range, electric variants that sit at a strikingly different level, and used options that often undercut new-vehicle prices—are not isolated data points. They are the visible edge of a longer story about a market that must balance affordability with reliability, efficiency with performance, and immediate needs with future obligations. In a country where compact goods, efficient logistics, and urban feasibility converge, the cost of a mini truck remains a practical proxy for the cost of keeping a business moving and a household connected. The price you encounter in a showroom or a dealer lot is the product of choices made upstream by policymakers, manufacturers, and buyers who, collectively, determine how much it costs to keep a little truck moving through Japan’s crowded streets.

If you would like to read more on how these market forces play out in related vehicle categories and to see how industry players discuss and reflect on these pricing dynamics, you can visit the broader discussion in the industry blog resource linked here. For a wider economic and policy context that helps illuminate why such price movements occur, the external resource noted below provides a comprehensive perspective on how electrification and policy shape costs across the sector.

External resource: https://iea.org/reports/global-ev-outlook

Final thoughts

In summary, understanding how much a Japanese mini truck costs involves navigating an array of factors from new versus used options to brand preferences and regional variations. These insights empower you to make informed decisions—whether you’re a small business owner aiming for efficiency, a property owner looking to expand your capabilities, or a mini truck enthusiast ready to invest in your next ride. By keeping an eye on market trends and recognizing the specific needs that different models meet, you’re better equipped to find the perfect mini truck that fits both your budget and requirements.